Health Insurance

This class of insurance provides Benefits in respect of Hospitalization, Surgery, Death or Treatment at a Hospital /Clinic caused by a Disease or Accident.

| Who can insure | Those aged between 6 and 75 years (individually or in a group) |

| Term (duration) | One year |

| Premium rate | This insurance consists of Basic Insurance Cover and Optional Insurance Cover. Premiums are charged, based on the type of Cover, no of Unit purchased and Assured’s age. |

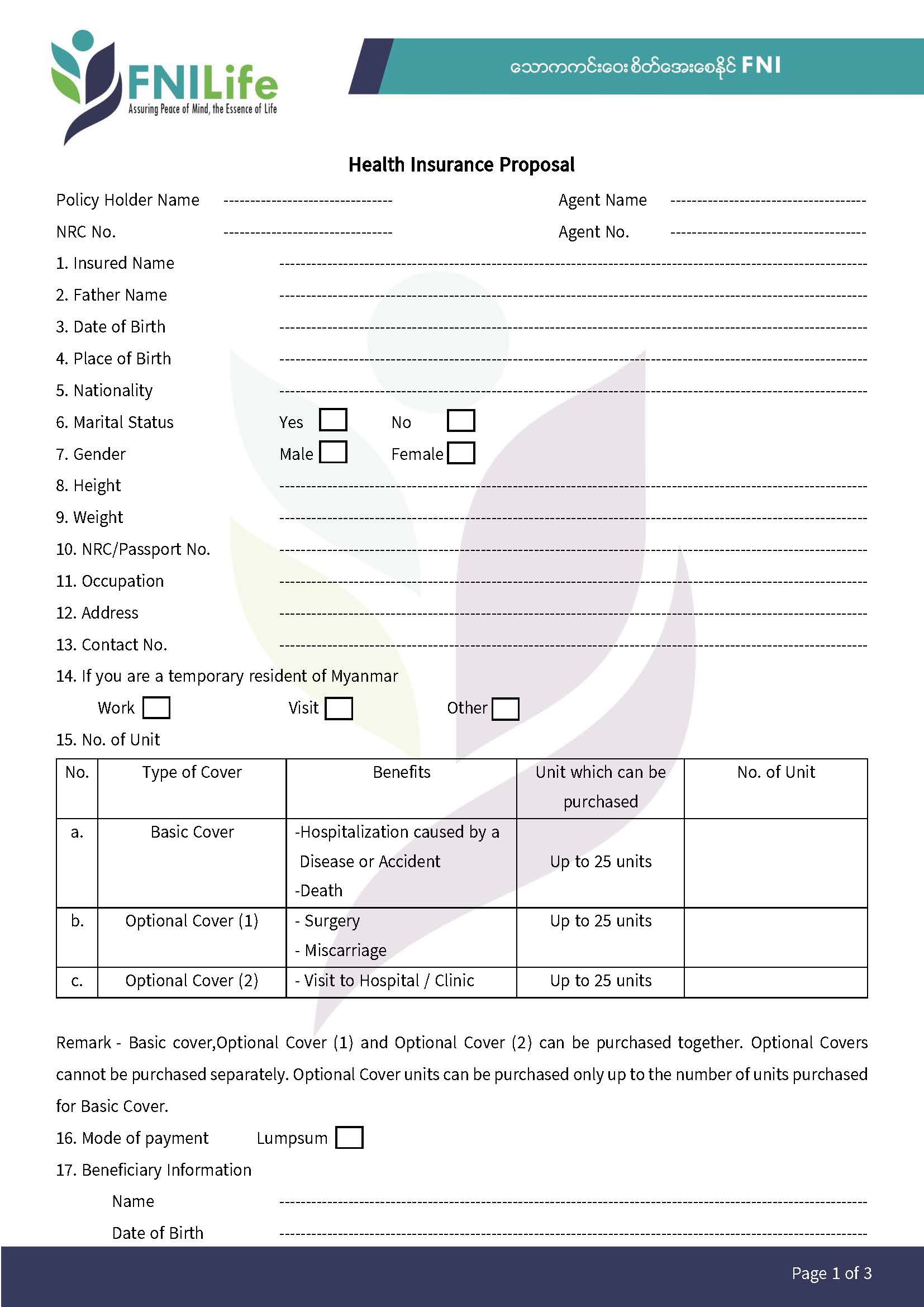

Type of Cover and No of Unit which can be purchased

| No | Cover | Unit which can be purchased |

| 1 | Basic Cover | From 1 to 25 units |

| 2 | Optional Cover (1) | From 1 to 25 units |

| 3 | Optional Cover (2) | From 1 to 25 units |

Benefits obtainable under this insurance

| No | Cover | Benefit | Benefit in kyats |

| 1 | Basic Cover – One Unit | Hospitalization caused or necessitated by a Disease or Accident | Kyats 10,000/- per day up to 60 days of hospitalization. |

| Death | Kyats 1,000,000/- (One Million) | ||

| 2 | Optional Cover (1) – One Unit | Surgery | Actual direct cost up to kyats 500,000/- |

| Miscarriage | Kyats 300,000/- irrespective of unit purchased. | ||

| Miscarriage concurrent with Surgery. For both kyats 500,000/-, the maximum amount obtainable for all units purchased. | |||

| 3 | Optional Cover (2) – One Unit | Visit to Hospital / Clinic for treatment | Kyats 2,500/- per visit up to kyats 10,000/-maximum amount obtainable for all units purchased. |

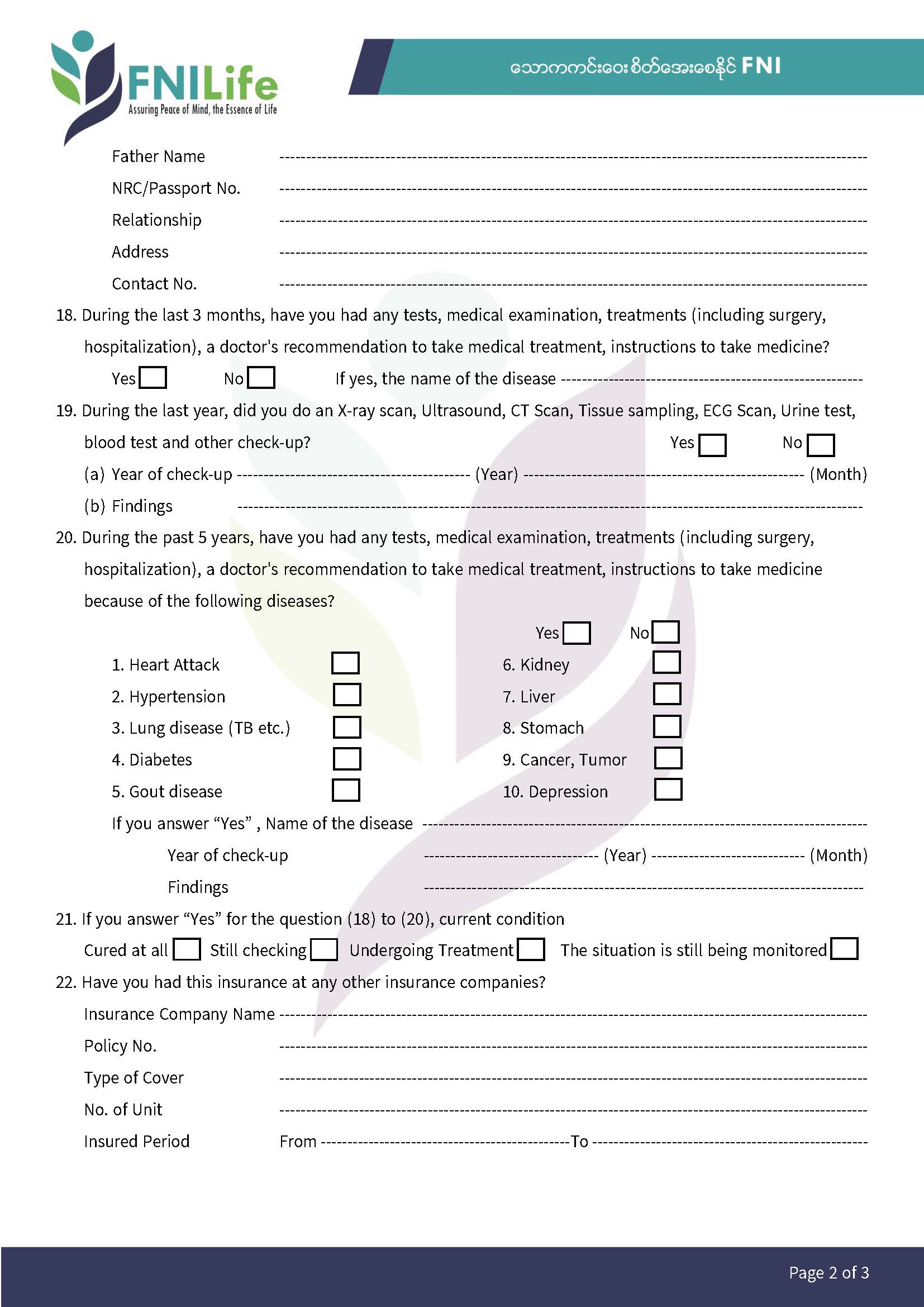

Only Basic cover and Not Optional Cover can be purchased singly. Optional Cover units can be purchased only up to the number of units purchased for Basic Cover.

No Benefit for the Following: —

No Benefit is obtainable for Injury, Disease, Hospitalization, Surgery, Miscarriage/ Abortion, Death and Visit for treatment to Hospital / Clinic caused or necessitated directly or indirectly by one of the following: —

- Under current medical treatment. The Assured is recommended by a doctor to be treated. Disease symptoms already confirmed.

- Caesarian birth. Surgery associated with Pregnancy. But Hospitalization and Surgery caused or necessitated by Pregnancy after inception of insurance and diseases usually associated with Pregnancy within insurance period (Eclampsia , Pregnancy Hypertension and Pregnancy Diabetes ) are covered. In case the Optional Cover (1) has been purchased, they are covered.

- Derangement caused by mental diseases.

- Hospitalization for medical check-up, rest and recuperation.

- Hospitalization and surgery for conception.

- Dental treatment not caused by an accident.

- Eye test including spectacles not caused by an accident. Loss of eye sights. Eye sights treatment. Treatment to improve eye sights.

- Beautification.

- To wear hearing aids.

- Physical defect or Infirmity.

- Use of narcotic drugs.

- Commission of a criminal offence.

- Contraction of AIDS / HIV.

- Terrorism acts. Riot. War and warlike operations.

- Medical treatments for which the Assured is hospitalized last 3 days only or less.

- Fraudulent claims

- Suicide or intentional self – injury.

If you want to buy this insurance, please contact First National Insurance (Life) Co.,Ltd. & F.N.I Branches or Insurance Agents dealing with FNI.

Health Insurance Terms & Conditions

Benefits

| Benefits for Basic Cover – One Unit(On and after the insurance commencement date) | |

| 1. | Kyats 10,000/- per day up to 60 days of hospitalization (for hospitalization caused or necessitated by a Disease or Accident) |

| 2. | Kyats 1,000,000/- (One Million) (for death) |

| Benefits for Optional Cover (1) – One Unit(On and after the insurance commencement date) | |

| 1. | Actual direct cost or the maximum amount kyats 500,000/- (for surgery only) |

| 2. | Kyats 300,000/- irrespective of unit purchased (for Miscarriage) |

| 3. | Kyats 500,000/- for both (for miscarriage concurrent with Surgery) |

| Benefits for Optional Cover (2) – One Unit(On and after the insurance commencement date) | |

| 1. | Kyats 2,500/- per visit up to kyats 10,000/- maximum amount obtainable for all units purchased (for visiting to Hospital/ Clinic for treatment) |

| No Benefit for the Following: – | |

| No Benefit is obtainable for Injury, Disease, Hospitalization, Surgery, Miscarriage/Abortion, Death and Visit for treatment to Hospital/Clinic caused or necessitated directly or indirectly by one of the following:- | |

| 1. | Under current medical treatment. The Assured is recommended by a doctor to be treated. Disease symptoms already confirmed. |

| 2. | Childbirth. Caesarian birth. Surgery associated with Pregnancy. But Hospitalization and Surgery caused or necessitated by Pregnancy after inception of insurance and diseases usually associated with Pregnancy within insurance period (Eclampsia, Pregnancy Hypertension and Pregnancy Diabetes) are covered. In case the Optional Cover (1) has been purchased, they are covered. |

| 3. | Derangement caused by mental diseases. |

| 4. | Hospitalization for medical check-up, rest and recuperation. |

| 5. | Hospitalization and surgery for conception. |

| 6. | Dental treatment not caused by an accident. |

| 7. | Eye test including spectacles not caused by an accident. Loss of eye sights. Eye sights treatment. Treatment to improve eye sights. |

| 8. | Beautification. |

| 9. | To wear hearing aids. |

| 10. | Physical defect or Infirmity. |

| 11. | Use of narcotic drugs. |

| 12. | Commission of a criminal offence. |

| 13. | Contraction of AIDS/HIV. |

| 14. | Terrorism acts. Riot. War and warlike operations. |

| 15. | Medical treatments for which the Assured is hospitalized last 3 days only or less. |

| 16. | Fraudulent claims |

| 17. | Suicide or intentional self-injury. |

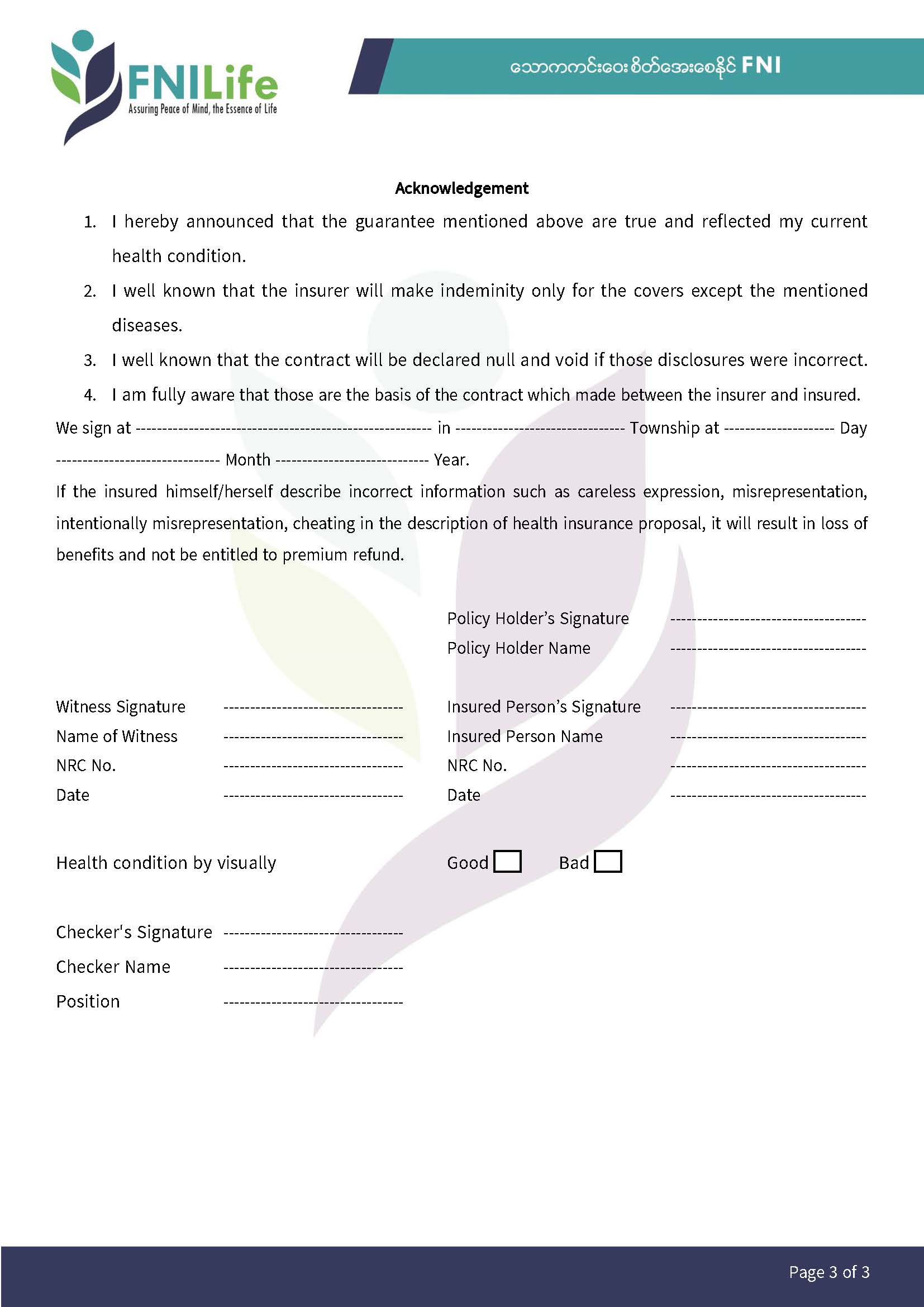

| Terms and Conditions | |

| 1. | If the insured himself/herself describe incorrect information such as careless expression, misrepresentation, deliberate misrepresentation, cheating in the description of health insurance proposal, it will result in loss of benefits. |

| 2. | The warranty period starts from the time of premium payment and expires at 12 noon on the first day of the first year. |

| 3. | If the insured terminates the insurance contract, you will not be entitled to premium refund. If the insurance company terminates, the premium will be refunded on a daily basis for the remaining period. |

| 4. | For the remaining period, the premium payment must be made within 15 days from the due date of the stated premium payment system. In case of compensation, the unpaid premium will be deducted from the benefit amount. |

| 5. | If the waiting period is exceeded, the insurance contract will be invalid from the next day after the end of the waiting period. |

| 6. | There is no waiting period for renewal insurance contracts. |

| 7. | The insured must notify the company in advance of any hospitalization and claim benefits along with a medical record within 10 working days of discharge. |

| 8. | Benefits will be forfeited if the claimant fails to submit the company’s additional requirements for claiming benefits within three months. |

| 9. | The company’s experts will review any cases reported for incidents that require hospitalization within one month of being insured. |

| 10. | Health insurance provides insurance coverage for hospitalization. It does not apply to hospitalizations for medical examination at the discretion of the insured. |

| 11. | Hospital/ Clinic screening benefits require confirmation of a hospital/clinic visit with a doctor’s medical certificate or medical record prescribed by this company. |

| 12. | Compensation will be paid at any time and place as applicable. |

Health Insurance Policy

| Agent Name ———————————— | Policy No. ———————————— | |||||||||||||||

| Agent ID ———————————— | Date ———————————— | |||||||||||||||

| Insured Name | ——————————————————————————————————————- | |||||||||||||||

| Address | ——————————————————————————————————————- | |||||||||||||||

| Insured Period | From ———————— To ——————— | |||||||||||||||

| Payment Type | ——————————————————————————————————————- | |||||||||||||||

|

||||||||||||||||

| Insured Person’s Information | ||||||||||||||||

| Father Name | ——————————————————————————————————————- | |||||||||||||||

| NRC/Passport No. | ——————————————————————————————————————- | |||||||||||||||

| Age | ——————————————————————————————————————- | |||||||||||||||

| Occupation | ——————————————————————————————————————- | |||||||||||||||

| Contact No. | ——————————————————————————————————————- | |||||||||||||||

| Beneficiary Information | ||||||||||||||||

| Name | ——————————————————————————————————————- | |||||||||||||||

| NRC/Passport No. | ——————————————————————————————————————- | |||||||||||||||

| Age | ——————————————————————————————————————- | |||||||||||||||

| Relationship | ——————————————————————————————————————- | |||||||||||||||

| Address | ——————————————————————————————————————- | |||||||||||||||

| Contact No. | ——————————————————————————————————————- | |||||||||||||||

| Due to the premium paid by the insured person, the company is solely responsible for providing compensation that depends on the number of units purchased to the insured person or beneficiary person in accordance with terms and conditions of this insurance agreement, future amendments for the insured person will be hospitalization, undergoing surgery, miscarriage, death, hospital/clinic screening during the above-mentioned insured period. | ||||||||||||||||

Authorized Officer

ကျန်းမာရေးအာမခံ လျော်ကြေးပေါ်ပေါက်ပါက ဆောင်ရွက်ရမည့်အချက်များ

| ရောဂါကြောင့်ဆေးရုံတက်ရခြင်း | ||

| ၁။ | အကြောင်းကြားစာ (Claim ဖြစ်သူ Customer)။ | |

| ၂။ | တောင်းခံလွှာ (Claims Form)။ | |

| ၃။ | Policy | |

| ၄။ | မှတ်ပုံတင်မိတ္တူ (Claim ဖြစ်သူ Customer)။ | |

| ၅။ | ဆေးမှတ်တမ်းစာအုပ် (ဖြစ်ပွားသည့်ရောဂါ ၊ ဆေးရုံတက်ရက်နှင့်ဆင်းရက် ပါဝင်ရမည်) (ပြည်ပတွင် ဖြစ်ပွားပါက ဆေးမှတ်တမ်းအား ဘာသာပြန်ပေးရပါမည်) | |

| ၆။ | ဆရာဝန်၏ ဆေးစစ်ချက်ထောက်ခံစာ။ | |

| မတော်တဆကြောင့်ဆေးရုံတက်ရခြင်း | ||

| ၁။ | အကြောင်းကြားစာ (Claim ဖြစ်သူ Customer)။ | |

| ၂။ | တောင်းခံလွှာ (Claims Form)။ | |

| ၃။ | Policy | |

| ၄။ | မှတ်ပုံတင်မိတ္တူ (Claim ဖြစ်သူ Customer)။ | |

| ၅။ | ဆေးမှတ်တမ်းစာအုပ် (Cause of Loss ၊ ဆေးရုံတက်ရက်နှင့်ဆင်းရက် ပါဝင်ရမည်) (ပြည်ပတွင် ဖြစ်ပွားပါကဆေးမှတ်တမ်းအား ဘာသာပြန်ပေးရပါမည်)။ | |

| ၆။ | ရဲစခန်းထောက်ခံစာ (ပြည်ပတွင် ဖြစ်ပွားပါက ထောက်ခံစာအား ဘာသာပြန်ပေးရပါမည်)။ | |

| သေဆုံးခြင်း | ||

| ၁။ | အကြောင်းကြားစာ (အကျိုးခံစားခွင့်လွှဲပြောင်းခံရသူ)။ | |

| ၂။ | တောင်းခံလွှာ (Claims Form)။ | |

| ၃။ | Policy စာချုပ်မူရင်း။ | |

| ၄။ | မှတ်ပုံတင်မိတ္တူ (သေဆုံးသူ ၊ အကျိုးခံစားခွင့်လွှဲပြောင်းခံရသူ)။ | |

| ၅။ | ဆေးမှတ်တမ်းစာအုပ် (ပြည်ပတွင် ဖြစ်ပွားပါက ဆေးမှတ်တမ်းအား ဘာသာပြန် ပေးရပါမည်)။ | |

| ၆။ | နာရေးဖိတ်စာ။ | |

| ၇။ | သန်းခေါင်စာရင်း။ | |

| ၈။ | Death Certificate (ပြည်ပတွင် ဖြစ်ပွားပါက Death Certificate အား ဘာသာပြန်ပေးရပါမည်)။ | |

| ၉။ | Police case ဖြစ်ပါက ရဲစခန်းထောက်ခံစာ (ပြည်ပတွင် ဖြစ်ပွားပါက ထောက်ခံစာအား ဘာသာပြန်ပေးရပါမည်)။ | |

| ခွဲစိတ်ကုသခြင်း | ||

| ၁။ | အကြောင်းကြားစာ (Claim ဖြစ်သူ Customer)။ | |

| ၂။ | တောင်းခံလွှာ (Claims Form)။ | |

| ၃။ | Policy | |

| ၄။ | မှတ်ပုံတင်မိတ္တူ (Claim ဖြစ်သူ Customer)။ | |

| ၅။ | ဆေးမှတ်တမ်းစာအုပ် (ဖြစ်ပွားသည့်ရောဂါ / Cause of Loss ပါဝင်ရမည်) (ပြည်ပတွင် ဖြစ်ပွားပါက ဆေးမှတ်တမ်းအား ဘာသာပြန်ပေးရပါမည်)။ | |

| ၆။ | ဆရာဝန်၏ ဆေးစစ်ချက် ထောက်ခံစာ။ | |

| ၇။ | ဆေးရုံမှထုတ်ပေးသည့်ငွေတောင်းခံလွှာ / ငွေလက်ခံဖြတ်ပိုင်း။ | |

| ကိုယ်ဝန်ပျက်ကျခြင်း | ||

| ၁။ | အကြောင်းကြားစာ (Claim ဖြစ်သူ Customer)။ | |

| ၂။ | တောင်းခံလွှာ (Claims Form)။ | |

| ၃။ | Policy | |

| ၄။ | မှတ်ပုံတင်မိတ္တူ (Claim ဖြစ်သူ Customer)။ | |

| ၅။ | ဆေးမှတ်တမ်းစာအုပ် (ဖြစ်ပွားသည့်ရောဂါ / Cause of Loss ပါဝင်ရမည်) (ပြည်ပတွင် ဖြစ်ပွားပါက ဆေးမှတ်တမ်းအား ဘာသာပြန်ပေးရပါမည်)။ | |

| ၆။ | ဆေးရုံမှထုတ်ပေးသည့်ငွေတောင်းခံလွှာ / ငွေလက်ခံဖြတ်ပိုင်း။ | |

| ဆေးရုံ၊ဆေးခန်းပြသခြင်း | ||

| ၁။ | အကြောင်းကြားစာ (Claim ဖြစ်သူ Customer)။ | |

| ၂။ | တောင်းခံလွှာ (Claims Form)။ | |

| ၃။ | Policy | |

| ၄။ | မှတ်ပုံတင်မိတ္တူ (Claim ဖြစ်သူ Customer)။ | |

| ၅။ | ဆေးမှတ်တမ်းစာအုပ် (ဖြစ်ပွားသည့်ရောဂါ / Cause of Loss ပါဝင်ရမည်) (ပြည်ပတွင် ဖြစ်ပွားပါကဆေးမှတ်တမ်းအား ဘာသာပြန်ပေးရပါမည်)။ | |

အာမခံထားသည့် လူပုဂ္ဂိုလ် (သို့မဟုတ်) အကျိုးခံစားခွင့်ရှိသူမှ ဆောင်ရွက်ရန်အဆင်မပြေပါက အဆိုပါပုဂ္ဂိုလ်မှ အခြားတစ်ဦးသို့ အကျိုးခံစားခွင့်လွှဲပြောင်းလုပ်ဆောင်ခွင့်ပြုကြောင်း အာမခံကုမ္ပဏီသို့ အကြောင်းကြားစာ ပါရှိရမည်။

FREQUENTLY ASKED QUESTIONS

HOW CAN WE HELP YOU?

If you have any question, please inquiry to 09-269843974, 01-570521, 01-570998 and customerservices@fnilife.com

Policy Term – (1) year

- Proposal

- NRC

- Passport Size Photo

Premium rate varies with the age and quantity of the Unit.

It can be bought for both.

No, it is not allowed to purchase optional coverage alone. Basic coverage must be bought in order to add optional coverage.

Usually it takes approximately 60~90 minutes if all documents are available.

Yes, FNI (Life) has One Stop Service.